(click to enlarge)

Magnificent graphic research of SG via Big Picture:

Is this a new product? No, not really. It is a simple variant of convertible bonds, that is called in France, the ocean (see our previous post http://investmentbankerparis.blogspot.com/2010/11/vive-les-emissions dobligations.html-) which is currently a very popular product investors lack of emissions.

Is this a new product? No, not really. It is a simple variant of convertible bonds, that is called in France, the ocean (see our previous post http://investmentbankerparis.blogspot.com/2010/11/vive-les-emissions dobligations.html-) which is currently a very popular product investors lack of emissions.  Kerosene constitutes a major cost for airlines that have got used to hedge (hedging) through derivatives markets against unforeseen developments in oil prices. This is an important part of the business relationship with investment banks such customers.

Kerosene constitutes a major cost for airlines that have got used to hedge (hedging) through derivatives markets against unforeseen developments in oil prices. This is an important part of the business relationship with investment banks such customers.  After deletion of Axel Weber, the German candidate, Mario Draghi, Governor of the Bank of Italy and Chairman of the Financial Stability Board (FSB), became the favorite for the very heavy estate of Jean-Claude Trichet as head of the ECB, in the autumn. Mario Draghi, nicknamed "Super Mario", will, however, yet to defeat his two handicaps: a brief stint at Goldman Sachs, having been Director of the Italian Treasury, before becoming the Governor of the Central Bank of the country and be Italian not from a country "more virtuous" in Northern Europe. This is probably unacceptable if one believes the tone of the very interesting portrait that just made the Spiegel, overall very positive (see link in English):

After deletion of Axel Weber, the German candidate, Mario Draghi, Governor of the Bank of Italy and Chairman of the Financial Stability Board (FSB), became the favorite for the very heavy estate of Jean-Claude Trichet as head of the ECB, in the autumn. Mario Draghi, nicknamed "Super Mario", will, however, yet to defeat his two handicaps: a brief stint at Goldman Sachs, having been Director of the Italian Treasury, before becoming the Governor of the Central Bank of the country and be Italian not from a country "more virtuous" in Northern Europe. This is probably unacceptable if one believes the tone of the very interesting portrait that just made the Spiegel, overall very positive (see link in English):  Glencore is a name little known outside insider. Yet it is a giant commodities trading, not hesitating to invest around the world. The firm, based in the Swiss canton of Zug, was established by the sulfur trader Marc Rich. Today a partnership, which has said it was the "Goldman Sachs" of its activities. It is a partner and a very important customer investment banks active in the commodities sector and mining.

Glencore is a name little known outside insider. Yet it is a giant commodities trading, not hesitating to invest around the world. The firm, based in the Swiss canton of Zug, was established by the sulfur trader Marc Rich. Today a partnership, which has said it was the "Goldman Sachs" of its activities. It is a partner and a very important customer investment banks active in the commodities sector and mining.  The article in the WSJ link underlines the dynamism of the U.S. market in IPO, which regained the lead on Asia who became the new location of choice for two years. There has been 24 IPOs since the beginning of the year United States and the pipeline is well stocked, with particularly strong buzz in the tech sector and internet

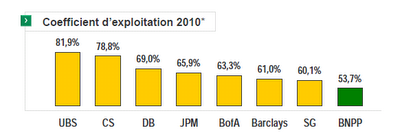

The article in the WSJ link underlines the dynamism of the U.S. market in IPO, which regained the lead on Asia who became the new location of choice for two years. There has been 24 IPOs since the beginning of the year United States and the pipeline is well stocked, with particularly strong buzz in the tech sector and internet  This chart is very telling of Figaro. BNP Paribas dominates the pack in terms of profits as net banking income (NBI), the total income of banks. Societe Generale is No. 2 in profits but No. 3 in GNP behind Credit Agricole. BPCE glued to the pack.

This chart is very telling of Figaro. BNP Paribas dominates the pack in terms of profits as net banking income (NBI), the total income of banks. Societe Generale is No. 2 in profits but No. 3 in GNP behind Credit Agricole. BPCE glued to the pack.  The Council of Financial Stability ( FSB), which is chaired by Mario Draghi, as usual before a summit of the G20, has recently published a report (10 pages) to a point on the state reform of financial regulation: Bâle3 and implementation of various new ratios (capital, liquidity, leverage), the OTC derivatives market reform, accounting standards ...

The Council of Financial Stability ( FSB), which is chaired by Mario Draghi, as usual before a summit of the G20, has recently published a report (10 pages) to a point on the state reform of financial regulation: Bâle3 and implementation of various new ratios (capital, liquidity, leverage), the OTC derivatives market reform, accounting standards ...  Hedge funds are not the preserve of Anglo-Saxon. They have grown significantly in Brazil in recent years - just like private equity - fueled by the desire to diversify and hedge the strong local industry pension funds (see previous post on pension funds in the world). These hedge funds are based more in Rio while the financial center is Sao Paulo.

Hedge funds are not the preserve of Anglo-Saxon. They have grown significantly in Brazil in recent years - just like private equity - fueled by the desire to diversify and hedge the strong local industry pension funds (see previous post on pension funds in the world). These hedge funds are based more in Rio while the financial center is Sao Paulo.  This graphic research of JP Morgan, alleging Business Insider, shows the evolution of asset allocation for institutional investors since 1989, from equities, fixed income and cash . Two major features: the importance of the cash position and the sharp decline in the equity component.

This graphic research of JP Morgan, alleging Business Insider, shows the evolution of asset allocation for institutional investors since 1989, from equities, fixed income and cash . Two major features: the importance of the cash position and the sharp decline in the equity component.

The consultant Towers Watson assesses the amount managed by pension funds about $ 30 trillion, 85% concentrated in 13 countries.

The consultant Towers Watson assesses the amount managed by pension funds about $ 30 trillion, 85% concentrated in 13 countries.  This graphic from The Economist, which questions the value of the investment banks under their new prospects ROE, shows the multiple changes in their action / net assets (book value). As can be seen these multiples, they have recovered, ranged between 0.9 and 1.5, below pre-crisis levels.

This graphic from The Economist, which questions the value of the investment banks under their new prospects ROE, shows the multiple changes in their action / net assets (book value). As can be seen these multiples, they have recovered, ranged between 0.9 and 1.5, below pre-crisis levels.  This graph, taken from the FT day and from a search of Morgan Stanley, illuminates the income mix of NYSE Euronext Deutsche Boerse.

This graph, taken from the FT day and from a search of Morgan Stanley, illuminates the income mix of NYSE Euronext Deutsche Boerse.