Monday, February 28, 2011

Sunday, February 27, 2011

Squirtle Pokemon Deluge Login

The hedging airlines

Kerosene constitutes a major cost for airlines that have got used to hedge (hedging) through derivatives markets against unforeseen developments in oil prices. This is an important part of the business relationship with investment banks such customers.

Kerosene constitutes a major cost for airlines that have got used to hedge (hedging) through derivatives markets against unforeseen developments in oil prices. This is an important part of the business relationship with investment banks such customers.

The graph above, taken from the FT and research at Morgan Stanley, is interesting because it shows that the coverage of needs (ie for the year 2011) is partial and, especially, following the uneven regions of the world: more important in Europe, where it is around 60% elsewhere, where it ranges between 25 and 35%.

Kerosene constitutes a major cost for airlines that have got used to hedge (hedging) through derivatives markets against unforeseen developments in oil prices. This is an important part of the business relationship with investment banks such customers.

Kerosene constitutes a major cost for airlines that have got used to hedge (hedging) through derivatives markets against unforeseen developments in oil prices. This is an important part of the business relationship with investment banks such customers. The graph above, taken from the FT and research at Morgan Stanley, is interesting because it shows that the coverage of needs (ie for the year 2011) is partial and, especially, following the uneven regions of the world: more important in Europe, where it is around 60% elsewhere, where it ranges between 25 and 35%.

Saturday, February 26, 2011

How To Delete Your Account On Soroity Life

Super Mario favorite to succeed JC Trichet?

After deletion of Axel Weber, the German candidate, Mario Draghi, Governor of the Bank of Italy and Chairman of the Financial Stability Board (FSB), became the favorite for the very heavy estate of Jean-Claude Trichet as head of the ECB, in the autumn. Mario Draghi, nicknamed "Super Mario", will, however, yet to defeat his two handicaps: a brief stint at Goldman Sachs, having been Director of the Italian Treasury, before becoming the Governor of the Central Bank of the country and be Italian not from a country "more virtuous" in Northern Europe. This is probably unacceptable if one believes the tone of the very interesting portrait that just made the Spiegel, overall very positive (see link in English):

After deletion of Axel Weber, the German candidate, Mario Draghi, Governor of the Bank of Italy and Chairman of the Financial Stability Board (FSB), became the favorite for the very heavy estate of Jean-Claude Trichet as head of the ECB, in the autumn. Mario Draghi, nicknamed "Super Mario", will, however, yet to defeat his two handicaps: a brief stint at Goldman Sachs, having been Director of the Italian Treasury, before becoming the Governor of the Central Bank of the country and be Italian not from a country "more virtuous" in Northern Europe. This is probably unacceptable if one believes the tone of the very interesting portrait that just made the Spiegel, overall very positive (see link in English):

-Linked Article-portrait of Spiegel:

After deletion of Axel Weber, the German candidate, Mario Draghi, Governor of the Bank of Italy and Chairman of the Financial Stability Board (FSB), became the favorite for the very heavy estate of Jean-Claude Trichet as head of the ECB, in the autumn. Mario Draghi, nicknamed "Super Mario", will, however, yet to defeat his two handicaps: a brief stint at Goldman Sachs, having been Director of the Italian Treasury, before becoming the Governor of the Central Bank of the country and be Italian not from a country "more virtuous" in Northern Europe. This is probably unacceptable if one believes the tone of the very interesting portrait that just made the Spiegel, overall very positive (see link in English):

After deletion of Axel Weber, the German candidate, Mario Draghi, Governor of the Bank of Italy and Chairman of the Financial Stability Board (FSB), became the favorite for the very heavy estate of Jean-Claude Trichet as head of the ECB, in the autumn. Mario Draghi, nicknamed "Super Mario", will, however, yet to defeat his two handicaps: a brief stint at Goldman Sachs, having been Director of the Italian Treasury, before becoming the Governor of the Central Bank of the country and be Italian not from a country "more virtuous" in Northern Europe. This is probably unacceptable if one believes the tone of the very interesting portrait that just made the Spiegel, overall very positive (see link in English): -Linked Article-portrait of Spiegel:

Digital Playground For Free Watch Online

Glencore, the IPO of the century in Europe

Glencore is a name little known outside insider. Yet it is a giant commodities trading, not hesitating to invest around the world. The firm, based in the Swiss canton of Zug, was established by the sulfur trader Marc Rich. Today a partnership, which has said it was the "Goldman Sachs" of its activities. It is a partner and a very important customer investment banks active in the commodities sector and mining.

Glencore is a name little known outside insider. Yet it is a giant commodities trading, not hesitating to invest around the world. The firm, based in the Swiss canton of Zug, was established by the sulfur trader Marc Rich. Today a partnership, which has said it was the "Goldman Sachs" of its activities. It is a partner and a very important customer investment banks active in the commodities sector and mining.

very committed to the discretion, Glencore has yet to decide to go public, what should be done in the second quarter, the London Stock Exchange. The company is valued at approximately USD 60 billion. It should merge with the mining group Xstrata, which it already controls, which should increase the value of total around 100 billion USD. This is a huge IPO, the largest in Europe, from large privatization.

Why Glencore has decided to rate? i) to maximize flexibility and be able, like its competitors, "paying paper" acquisitions (eg for the likely merger with Xstrata) ii) to enable partners to liquefy a heritage become significant.

An important consequence will be to acknowledge again the component raw materials "from the London Stock Exchange and FTSE, which already includes giants like BHP Billiton, Rio Tinto, Anglo American, Xstrata and others.

We therefore read with interest, linked along "report" that Reuters has just devoted to Glencore, and at least the post's comments Reuters blogger, Felix Slamon.

-Felix Salmon's comments

http://blogs.reuters.com/felix-salmon/2011/02/25/why-glencores-going-public/

-Reuters Report on the Glencore:

http://uk.reuters.com/article/2011/02/25/uk-glencore-idUKTRE71O1AX20110225?pageNumber=1

Glencore is a name little known outside insider. Yet it is a giant commodities trading, not hesitating to invest around the world. The firm, based in the Swiss canton of Zug, was established by the sulfur trader Marc Rich. Today a partnership, which has said it was the "Goldman Sachs" of its activities. It is a partner and a very important customer investment banks active in the commodities sector and mining.

Glencore is a name little known outside insider. Yet it is a giant commodities trading, not hesitating to invest around the world. The firm, based in the Swiss canton of Zug, was established by the sulfur trader Marc Rich. Today a partnership, which has said it was the "Goldman Sachs" of its activities. It is a partner and a very important customer investment banks active in the commodities sector and mining. very committed to the discretion, Glencore has yet to decide to go public, what should be done in the second quarter, the London Stock Exchange. The company is valued at approximately USD 60 billion. It should merge with the mining group Xstrata, which it already controls, which should increase the value of total around 100 billion USD. This is a huge IPO, the largest in Europe, from large privatization.

Why Glencore has decided to rate? i) to maximize flexibility and be able, like its competitors, "paying paper" acquisitions (eg for the likely merger with Xstrata) ii) to enable partners to liquefy a heritage become significant.

An important consequence will be to acknowledge again the component raw materials "from the London Stock Exchange and FTSE, which already includes giants like BHP Billiton, Rio Tinto, Anglo American, Xstrata and others.

We therefore read with interest, linked along "report" that Reuters has just devoted to Glencore, and at least the post's comments Reuters blogger, Felix Slamon.

-Felix Salmon's comments

http://blogs.reuters.com/felix-salmon/2011/02/25/why-glencores-going-public/

-Reuters Report on the Glencore:

http://uk.reuters.com/article/2011/02/25/uk-glencore-idUKTRE71O1AX20110225?pageNumber=1

Stem Cell Hair Regrowthresearch

The United States again at the forefront of IPO

The article in the WSJ link underlines the dynamism of the U.S. market in IPO, which regained the lead on Asia who became the new location of choice for two years. There has been 24 IPOs since the beginning of the year United States and the pipeline is well stocked, with particularly strong buzz in the tech sector and internet

The article in the WSJ link underlines the dynamism of the U.S. market in IPO, which regained the lead on Asia who became the new location of choice for two years. There has been 24 IPOs since the beginning of the year United States and the pipeline is well stocked, with particularly strong buzz in the tech sector and internet

The article in the WSJ link underlines the dynamism of the U.S. market in IPO, which regained the lead on Asia who became the new location of choice for two years. There has been 24 IPOs since the beginning of the year United States and the pipeline is well stocked, with particularly strong buzz in the tech sector and internet

The article in the WSJ link underlines the dynamism of the U.S. market in IPO, which regained the lead on Asia who became the new location of choice for two years. There has been 24 IPOs since the beginning of the year United States and the pipeline is well stocked, with particularly strong buzz in the tech sector and internet Friday, February 25, 2011

Possiblity Calculator

The winners of the French banks by the level of their profits

This chart is very telling of Figaro. BNP Paribas dominates the pack in terms of profits as net banking income (NBI), the total income of banks. Societe Generale is No. 2 in profits but No. 3 in GNP behind Credit Agricole. BPCE glued to the pack.

This chart is very telling of Figaro. BNP Paribas dominates the pack in terms of profits as net banking income (NBI), the total income of banks. Societe Generale is No. 2 in profits but No. 3 in GNP behind Credit Agricole. BPCE glued to the pack.

We read more comments in the article in Figaro link under the pen Isabelle Chaperon, specialist, long date, the banking sector.

Linked:

-section of Le Figaro

http://www.lefigaro.fr/societes/2011/02/24/04015-20110224ARTFIG00716-la-hierarchie-des-banques-francaises-bouleversee.php

-AFP dispatch read as the health of French banks:

http://www.boursorama.com/infos/actualites/detail_actu_marches.phtml?num=e019fe2ccd8c142fb000ce4d08b080a1

This chart is very telling of Figaro. BNP Paribas dominates the pack in terms of profits as net banking income (NBI), the total income of banks. Societe Generale is No. 2 in profits but No. 3 in GNP behind Credit Agricole. BPCE glued to the pack.

This chart is very telling of Figaro. BNP Paribas dominates the pack in terms of profits as net banking income (NBI), the total income of banks. Societe Generale is No. 2 in profits but No. 3 in GNP behind Credit Agricole. BPCE glued to the pack. We read more comments in the article in Figaro link under the pen Isabelle Chaperon, specialist, long date, the banking sector.

Linked:

-section of Le Figaro

http://www.lefigaro.fr/societes/2011/02/24/04015-20110224ARTFIG00716-la-hierarchie-des-banques-francaises-bouleversee.php

-AFP dispatch read as the health of French banks:

http://www.boursorama.com/infos/actualites/detail_actu_marches.phtml?num=e019fe2ccd8c142fb000ce4d08b080a1

Tuesday, February 22, 2011

Homemade Dipping Machine

An update on the reform of financial regulation and the shadow banking "

The Council of Financial Stability ( FSB), which is chaired by Mario Draghi, as usual before a summit of the G20, has recently published a report (10 pages) to a point on the state reform of financial regulation: Bâle3 and implementation of various new ratios (capital, liquidity, leverage), the OTC derivatives market reform, accounting standards ...

The Council of Financial Stability ( FSB), which is chaired by Mario Draghi, as usual before a summit of the G20, has recently published a report (10 pages) to a point on the state reform of financial regulation: Bâle3 and implementation of various new ratios (capital, liquidity, leverage), the OTC derivatives market reform, accounting standards ...

A new topic of reform was put on the agenda of this Council, which serves as secretariat for the G20 issues of financial regulation: the "shadow banking".

The "shadow banking" has played, in fact, a major role in the subprime crisis. Yet the reform of the U.S. regulatory site Dodd-Frank do there is little interest (but Bâle3 a little more), leaving widely unregulated. That is why the FSB was seized of the matter.

The rise of "shadow banking" has taken place over the last three decades, especially in the USA, without one there pays much attention. Besides, he was named thus for the first time only in 2007 by Paul Mac Culley of PIMCO. It was largely because the banks putting assets off balance sheet (off balance sheet) using various techniques, including securitization (CDOs, ABS, ABCP ...) and special purpose vehicles (SPVs).

Only with the crisis that we became aware of its magnitude and the fact that in 2007 the assets of the "shadow banking" amount had exceeded those in the banking world "regulated" (see chart below from a study of the New York Fed). In other words, the economy and U.S. companies had become increasingly financed by the "shadow banking" by traditional financial channels.

is contained in the link:

-route point of the Financial Stability Board

http://www.financialstabilityboard.org/publications/r_110219.pdf

-A recent study by two researchers at Yale School of Management "Regulating the shadow banking" in July 2010:

C: \\ Users \\ vincent \\ Documents \\ book IBK \\ SSRN-Regulating the Shadow Banking System by Gary Gorton, Andrew Metrick.mht

The Council of Financial Stability ( FSB), which is chaired by Mario Draghi, as usual before a summit of the G20, has recently published a report (10 pages) to a point on the state reform of financial regulation: Bâle3 and implementation of various new ratios (capital, liquidity, leverage), the OTC derivatives market reform, accounting standards ...

The Council of Financial Stability ( FSB), which is chaired by Mario Draghi, as usual before a summit of the G20, has recently published a report (10 pages) to a point on the state reform of financial regulation: Bâle3 and implementation of various new ratios (capital, liquidity, leverage), the OTC derivatives market reform, accounting standards ... A new topic of reform was put on the agenda of this Council, which serves as secretariat for the G20 issues of financial regulation: the "shadow banking".

The "shadow banking" has played, in fact, a major role in the subprime crisis. Yet the reform of the U.S. regulatory site Dodd-Frank do there is little interest (but Bâle3 a little more), leaving widely unregulated. That is why the FSB was seized of the matter.

The rise of "shadow banking" has taken place over the last three decades, especially in the USA, without one there pays much attention. Besides, he was named thus for the first time only in 2007 by Paul Mac Culley of PIMCO. It was largely because the banks putting assets off balance sheet (off balance sheet) using various techniques, including securitization (CDOs, ABS, ABCP ...) and special purpose vehicles (SPVs).

Only with the crisis that we became aware of its magnitude and the fact that in 2007 the assets of the "shadow banking" amount had exceeded those in the banking world "regulated" (see chart below from a study of the New York Fed). In other words, the economy and U.S. companies had become increasingly financed by the "shadow banking" by traditional financial channels.

is contained in the link:

-route point of the Financial Stability Board

http://www.financialstabilityboard.org/publications/r_110219.pdf

-A recent study by two researchers at Yale School of Management "Regulating the shadow banking" in July 2010:

C: \\ Users \\ vincent \\ Documents \\ book IBK \\ SSRN-Regulating the Shadow Banking System by Gary Gorton, Andrew Metrick.mht

Monday, February 21, 2011

How To Make A Guyfawke

The hedge fund industry in Brazil

Hedge funds are not the preserve of Anglo-Saxon. They have grown significantly in Brazil in recent years - just like private equity - fueled by the desire to diversify and hedge the strong local industry pension funds (see previous post on pension funds in the world). These hedge funds are based more in Rio while the financial center is Sao Paulo.

Hedge funds are not the preserve of Anglo-Saxon. They have grown significantly in Brazil in recent years - just like private equity - fueled by the desire to diversify and hedge the strong local industry pension funds (see previous post on pension funds in the world). These hedge funds are based more in Rio while the financial center is Sao Paulo.

Hedge funds are not the preserve of Anglo-Saxon. They have grown significantly in Brazil in recent years - just like private equity - fueled by the desire to diversify and hedge the strong local industry pension funds (see previous post on pension funds in the world). These hedge funds are based more in Rio while the financial center is Sao Paulo.

Hedge funds are not the preserve of Anglo-Saxon. They have grown significantly in Brazil in recent years - just like private equity - fueled by the desire to diversify and hedge the strong local industry pension funds (see previous post on pension funds in the world). These hedge funds are based more in Rio while the financial center is Sao Paulo. Read the article in The Economist Link:

http://www.economist.com/node/18178275 Miosotis Boobs Weigth

The evolution of asset allocation for institutional investors worldwide

This graphic research of JP Morgan, alleging Business Insider, shows the evolution of asset allocation for institutional investors since 1989, from equities, fixed income and cash . Two major features: the importance of the cash position and the sharp decline in the equity component.

This graphic research of JP Morgan, alleging Business Insider, shows the evolution of asset allocation for institutional investors since 1989, from equities, fixed income and cash . Two major features: the importance of the cash position and the sharp decline in the equity component.

post

This graphic research of JP Morgan, alleging Business Insider, shows the evolution of asset allocation for institutional investors since 1989, from equities, fixed income and cash . Two major features: the importance of the cash position and the sharp decline in the equity component.

This graphic research of JP Morgan, alleging Business Insider, shows the evolution of asset allocation for institutional investors since 1989, from equities, fixed income and cash . Two major features: the importance of the cash position and the sharp decline in the equity component. Linked Business Insider:

Saturday, February 19, 2011

Normal Triglyceride Level

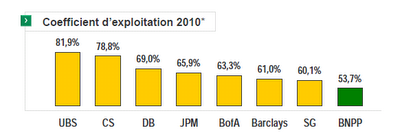

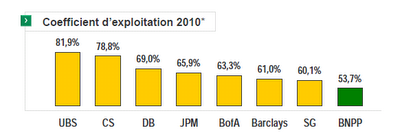

The cost to income ratio of investment banks

In paper presentations on its results, BNP Paribas provides for 2010, this graphic comparison of operating ratios (cost to income ratio) of investment banking activities, ie the proportion of revenue represented by the costs. These costs are known, are represented in 2 / 3 per pay.

This indicator is intended as a measure of operational efficiency the bank. Nevertheless, it is to be used with caution because the cost to income ratio will depend product mix of each investment bank. Some activities, such as brokerage or corporate finance have a high cost to income ratio because it's all about "people business" but using little capital and can be very profitable. In contrast to market activities and structured finance have operating ratios much lower but are heavy users of capital. This explains, in addition to good management, low operating rate of the two banks françaises.C is also explains that one can have, such as Credit Suisse, a high operating ratio from along with high profitability (see the graphs of a previous post: http://investmentbankerparis.blogspot.com/2011/02/profitabilite-et-profits-des-grandes.html )

This indicator is intended as a measure of operational efficiency the bank. Nevertheless, it is to be used with caution because the cost to income ratio will depend product mix of each investment bank. Some activities, such as brokerage or corporate finance have a high cost to income ratio because it's all about "people business" but using little capital and can be very profitable. In contrast to market activities and structured finance have operating ratios much lower but are heavy users of capital. This explains, in addition to good management, low operating rate of the two banks françaises.C is also explains that one can have, such as Credit Suisse, a high operating ratio from along with high profitability (see the graphs of a previous post: http://investmentbankerparis.blogspot.com/2011/02/profitabilite-et-profits-des-grandes.html )

Kjates Playground 2010

The weight of pension funds

The consultant Towers Watson assesses the amount managed by pension funds about $ 30 trillion, 85% concentrated in 13 countries.

The consultant Towers Watson assesses the amount managed by pension funds about $ 30 trillion, 85% concentrated in 13 countries.

The consultant Towers Watson assesses the amount managed by pension funds about $ 30 trillion, 85% concentrated in 13 countries.

The consultant Towers Watson assesses the amount managed by pension funds about $ 30 trillion, 85% concentrated in 13 countries. The above graph from The Economist expresses the weight of pension funds as a proportion of GDP countries concerned. The Netherlands topped the list (134%) followed by Switzerland and the United States. In amounts managed, it is the United States, of course, shows the highest (15.3 trillion USD), followed by Japan (3.5) and the United Kingdom (2.3).

Linked:

- the comment from The Economist:

- our previous post on the main actors of institutional savings:

http://investmentbankerparis.blogspot.com/2011/02 / the great-actor-of-lepargne.html Friday, February 18, 2011

Ball Position And Placement For Short Iron

Valuation stock market investment banks

This graphic from The Economist, which questions the value of the investment banks under their new prospects ROE, shows the multiple changes in their action / net assets (book value). As can be seen these multiples, they have recovered, ranged between 0.9 and 1.5, below pre-crisis levels.

This graphic from The Economist, which questions the value of the investment banks under their new prospects ROE, shows the multiple changes in their action / net assets (book value). As can be seen these multiples, they have recovered, ranged between 0.9 and 1.5, below pre-crisis levels.

Linked article from The Economist ("The big squeeze"):

This graphic from The Economist, which questions the value of the investment banks under their new prospects ROE, shows the multiple changes in their action / net assets (book value). As can be seen these multiples, they have recovered, ranged between 0.9 and 1.5, below pre-crisis levels.

This graphic from The Economist, which questions the value of the investment banks under their new prospects ROE, shows the multiple changes in their action / net assets (book value). As can be seen these multiples, they have recovered, ranged between 0.9 and 1.5, below pre-crisis levels. Linked article from The Economist ("The big squeeze"):

Estate Planning Investor Questionnaire Profile

income mix NYE Euronext / Deutsche Börse

This graph, taken from the FT day and from a search of Morgan Stanley, illuminates the income mix of NYSE Euronext Deutsche Boerse.

This graph, taken from the FT day and from a search of Morgan Stanley, illuminates the income mix of NYSE Euronext Deutsche Boerse.

As can be seen in the derivatives business-clearing is the main ingredient (37%) very much to the traditional business of listing and trading of shares "cash" (29%).

This component derivatives and clearing is expected to grow with the reform of the derivatives markets CTA (see previous post http://investmentbankerparis.blogspot.com/2011/02/les-bourses-en-fusion.html ) which aim i) to extend the Clearing (clearing) markets OTC derivatives and ii) to direct some to organized markets. This is a major driver of this consolidation.

This graph, taken from the FT day and from a search of Morgan Stanley, illuminates the income mix of NYSE Euronext Deutsche Boerse.

This graph, taken from the FT day and from a search of Morgan Stanley, illuminates the income mix of NYSE Euronext Deutsche Boerse. As can be seen in the derivatives business-clearing is the main ingredient (37%) very much to the traditional business of listing and trading of shares "cash" (29%).

This component derivatives and clearing is expected to grow with the reform of the derivatives markets CTA (see previous post http://investmentbankerparis.blogspot.com/2011/02/les-bourses-en-fusion.html ) which aim i) to extend the Clearing (clearing) markets OTC derivatives and ii) to direct some to organized markets. This is a major driver of this consolidation.

Thursday, February 17, 2011

Preventions Of Bulimia

Profitability and profits of large international banks

The presentation of the results of BNP Paribas today has two slides that can make a very telling statement in profitability (ROE ) and profits absolute amounts of a sample of large international banks.

The presentation of the results of BNP Paribas today has two slides that can make a very telling statement in profitability (ROE ) and profits absolute amounts of a sample of large international banks.

be noted that the classification is not the same under both criteria. ROE is an indicator (profitability) is substantial, but the amount of profits as well because it is a measure of the strength and robustness of the Bank.

Linked presenting the results of BNP Paribas

http://media-cms.bnpparibas.com/file/16/6/4t10-diapositives-fr.13166.pdf

http://media-cms.bnpparibas.com/file/16/6/4t10-diapositives-fr.13166.pdf

Wednesday, February 16, 2011

Lowered White Silverado On Black Rims

The comparative performance of the Venture and Private Equity USA

This table from a Fortune article compares the changes over a long period of Venture and Private Equity States united against the indices. Statistics show that Cambridge Associates Venture has underperformed relative to the index of private equity on 1, 3, 5 and 10 years, but outperformed by cons on 15 and 20 years.

In the Fortune article link:

http://finance.fortune.cnn.com/2011/02/16/venture-capital-returns-more-in-short-term-less-in- Long-term /

http://finance.fortune.cnn.com/2011/02/16/venture-capital-returns-more-in-short-term-less-in- Long-term /

Sunday, February 13, 2011

Potluck Breakfast Ideas

The world of private equity in France

Michel Chevallier and Dominique Langlois viewers are engaged, but critical thinking, private equity, as they are fund managers of private equity funds. They published an original book about the world of private equity in France by Editions Economica "Private Equity and Corporate Management": i) they focus on the relationship of private equity firms and companies they buy and their management in every sense of the term, ii) they describe the world of private equity in France, which they trace the different stages, with different actors: the private equity firms, investment bankers and the bankers financing, mezzanine providers, management and its own advisors, lawyers, auditors ... iii) they have based their work on a multitude of interviews and testimonials that give flesh to the material, making this book as a portrait gallery.

Michel Chevallier and Dominique Langlois viewers are engaged, but critical thinking, private equity, as they are fund managers of private equity funds. They published an original book about the world of private equity in France by Editions Economica "Private Equity and Corporate Management": i) they focus on the relationship of private equity firms and companies they buy and their management in every sense of the term, ii) they describe the world of private equity in France, which they trace the different stages, with different actors: the private equity firms, investment bankers and the bankers financing, mezzanine providers, management and its own advisors, lawyers, auditors ... iii) they have based their work on a multitude of interviews and testimonials that give flesh to the material, making this book as a portrait gallery.

A feature of the French private equity market is that it is very active, is most active in Europe after the United Kingdom, and one of the world's largest. And unlike other European markets, and it very striking, it is dominated by French actors, present in different market segments: PAI and Eurazeo for big deals, AXA Private Equity, LBO France, Sagard Astorg Central BPE or 21 for the class below etc ... Large international funds (CVC, Permira, KKR ...) are thus much less active and less present elsewhere in Europe. The string of private equity players, France, is very professional, banks are very active, with pioneers in the trade that were Maurice Tchenio (Apax), IDI or Banexi.

Another observation: management plays a key role and it is very treated well: "The management packages in France were the best in Europe" is found there. This explains a tendency to LBO secondary, "tertiary". Managers who have tasted the financial benefits of an LBO, but also the independence and focus of management which result are not very tempted to join and Industrial Group to (re) become more or less distant Division .

A fascinating read, highly recommended to all those who, directly or indirectly interested in this universe.

Michel Chevallier and Dominique Langlois viewers are engaged, but critical thinking, private equity, as they are fund managers of private equity funds. They published an original book about the world of private equity in France by Editions Economica "Private Equity and Corporate Management": i) they focus on the relationship of private equity firms and companies they buy and their management in every sense of the term, ii) they describe the world of private equity in France, which they trace the different stages, with different actors: the private equity firms, investment bankers and the bankers financing, mezzanine providers, management and its own advisors, lawyers, auditors ... iii) they have based their work on a multitude of interviews and testimonials that give flesh to the material, making this book as a portrait gallery.

Michel Chevallier and Dominique Langlois viewers are engaged, but critical thinking, private equity, as they are fund managers of private equity funds. They published an original book about the world of private equity in France by Editions Economica "Private Equity and Corporate Management": i) they focus on the relationship of private equity firms and companies they buy and their management in every sense of the term, ii) they describe the world of private equity in France, which they trace the different stages, with different actors: the private equity firms, investment bankers and the bankers financing, mezzanine providers, management and its own advisors, lawyers, auditors ... iii) they have based their work on a multitude of interviews and testimonials that give flesh to the material, making this book as a portrait gallery. A feature of the French private equity market is that it is very active, is most active in Europe after the United Kingdom, and one of the world's largest. And unlike other European markets, and it very striking, it is dominated by French actors, present in different market segments: PAI and Eurazeo for big deals, AXA Private Equity, LBO France, Sagard Astorg Central BPE or 21 for the class below etc ... Large international funds (CVC, Permira, KKR ...) are thus much less active and less present elsewhere in Europe. The string of private equity players, France, is very professional, banks are very active, with pioneers in the trade that were Maurice Tchenio (Apax), IDI or Banexi.

Another observation: management plays a key role and it is very treated well: "The management packages in France were the best in Europe" is found there. This explains a tendency to LBO secondary, "tertiary". Managers who have tasted the financial benefits of an LBO, but also the independence and focus of management which result are not very tempted to join and Industrial Group to (re) become more or less distant Division .

A fascinating read, highly recommended to all those who, directly or indirectly interested in this universe.

Saturday, February 12, 2011

Ftse 250 List By Market Capitalisation

The business mix of the Credit Suisse Investment Banking

Double-click the slide to enlarge

Double-click the slide to enlarge

At its recent annual results presentation 2010, Credit Suisse has presented the slide above, which describes its business mix in investment banking and its specific positioning.

The slide show was intended to show that the bulk of business is a business with customers and that what might be some sort of proprietary trading accounts for only 9% of total revenues. We take with a pinch of salt because we know that outside activities that are clearly prop trading, what the Americans call "bright line" prop trading, there is a gray area where borders are blurred. But There is no doubt that Credit Suisse has mastered and confined its proprietary trading, which allowed him to cross elsewhere without too much difficulty and crisis to be listed in the case of "winners".

As for his business mix, since it is specific investment banking (corporate finance) represents 25% of revenues (cons a little less than 20% industry average), the activity shares 33% (cons a bit over 20% in industry) and Part FICC 33% (whereas it is about 60% in industry). In other words, Credit Suisse is overweight in Corporate Finance and stocks and underweight in FICC, what a rather favorable position in terms of profitability.

be added that Credit Suisse is also one of most investment banks active in emerging markets, the new Eldorado. Which is all well and good but does not prevent the bank to lower targets ROE, as it is mentioned in a previous post, just to adapt to present times.

Double-click the slide to enlarge

Double-click the slide to enlarge At its recent annual results presentation 2010, Credit Suisse has presented the slide above, which describes its business mix in investment banking and its specific positioning.

The slide show was intended to show that the bulk of business is a business with customers and that what might be some sort of proprietary trading accounts for only 9% of total revenues. We take with a pinch of salt because we know that outside activities that are clearly prop trading, what the Americans call "bright line" prop trading, there is a gray area where borders are blurred. But There is no doubt that Credit Suisse has mastered and confined its proprietary trading, which allowed him to cross elsewhere without too much difficulty and crisis to be listed in the case of "winners".

As for his business mix, since it is specific investment banking (corporate finance) represents 25% of revenues (cons a little less than 20% industry average), the activity shares 33% (cons a bit over 20% in industry) and Part FICC 33% (whereas it is about 60% in industry). In other words, Credit Suisse is overweight in Corporate Finance and stocks and underweight in FICC, what a rather favorable position in terms of profitability.

be added that Credit Suisse is also one of most investment banks active in emerging markets, the new Eldorado. Which is all well and good but does not prevent the bank to lower targets ROE, as it is mentioned in a previous post, just to adapt to present times.

Friday, February 11, 2011

Woman Wearing Bottomless

Scholarships molten ROE

The exchange consolidation has accelerated sharply with the almost simultaneous announcement of the marriage between the London Stock Exchange (LSE) and the Toronto Stock Exchange (TMX Group) and the engagement between NYSE Euronext and the Deutsche Börse.

The exchange consolidation has accelerated sharply with the almost simultaneous announcement of the marriage between the London Stock Exchange (LSE) and the Toronto Stock Exchange (TMX Group) and the engagement between NYSE Euronext and the Deutsche Börse.

This last move would be the most formidable, with a new entity that would give a majority in the Frankfurt stock exchange and which would mark, no doubt, a further marginalization of the Paris.

Such approximation to see the day must overcome a number of obstacles including the acceptance by the authorities German American leadership and the Brussels agreement on the very strong position in Europe resulting from the combination of Euronext and Deutsche Börse. Obtaining various agreements require far less a year.

integration of Euronext and Deutsche Börse will not be easy either as their business model against. NYSE-Euronext only includes cash trading platform, derivatives (LIFFE, London). The model "silo" of Deutsche Börse, for its part, very different. It integrates the entire chain of trading orders to their outcome: the award-

cash: Deutsche Börse

-Exchange Derivatives: EUREX

-clearing: Eurex Clearing-

the central depository Clearstream

-system settlement: Clearstream

The main driver of this consolidation is to be sought in the derivatives markets , the most profitable activity scholarships, who knows the greatest growth. The OTC derivatives market reform which is underway, will also result in a return of part of the OTC market, OTC, most of the derivatives business today, to organized markets. It a considerable challenge for scholarships than winning this new business.

Thanks to this consolidation, EUREX, the No. 2 global derivatives markets "organized", would be able to acquire a dominant position entirely in Europe, Euronext LIFFE, and a strong position in the U.S. with the NYSE. It is a major challenge for the world No. 1, CME, Chicago, which would be hardest compete at home and deprived of its opportunities for expansion in Europe. So the CME could lay his heart on his neighbor, the other major derivatives market in Chicago, the CBOE.

Asia remains away from this consolidation frenzy, surfing on a fast-growing business. The consolidation of stock exchanges in Asia, outside of the merger between Singapore and Sydney, is not truly committed.

The exchange consolidation has accelerated sharply with the almost simultaneous announcement of the marriage between the London Stock Exchange (LSE) and the Toronto Stock Exchange (TMX Group) and the engagement between NYSE Euronext and the Deutsche Börse.

The exchange consolidation has accelerated sharply with the almost simultaneous announcement of the marriage between the London Stock Exchange (LSE) and the Toronto Stock Exchange (TMX Group) and the engagement between NYSE Euronext and the Deutsche Börse. This last move would be the most formidable, with a new entity that would give a majority in the Frankfurt stock exchange and which would mark, no doubt, a further marginalization of the Paris.

Such approximation to see the day must overcome a number of obstacles including the acceptance by the authorities German American leadership and the Brussels agreement on the very strong position in Europe resulting from the combination of Euronext and Deutsche Börse. Obtaining various agreements require far less a year.

integration of Euronext and Deutsche Börse will not be easy either as their business model against. NYSE-Euronext only includes cash trading platform, derivatives (LIFFE, London). The model "silo" of Deutsche Börse, for its part, very different. It integrates the entire chain of trading orders to their outcome: the award-

cash: Deutsche Börse

-Exchange Derivatives: EUREX

-clearing: Eurex Clearing-

the central depository Clearstream

-system settlement: Clearstream

The main driver of this consolidation is to be sought in the derivatives markets , the most profitable activity scholarships, who knows the greatest growth. The OTC derivatives market reform which is underway, will also result in a return of part of the OTC market, OTC, most of the derivatives business today, to organized markets. It a considerable challenge for scholarships than winning this new business.

Thanks to this consolidation, EUREX, the No. 2 global derivatives markets "organized", would be able to acquire a dominant position entirely in Europe, Euronext LIFFE, and a strong position in the U.S. with the NYSE. It is a major challenge for the world No. 1, CME, Chicago, which would be hardest compete at home and deprived of its opportunities for expansion in Europe. So the CME could lay his heart on his neighbor, the other major derivatives market in Chicago, the CBOE.

Asia remains away from this consolidation frenzy, surfing on a fast-growing business. The consolidation of stock exchanges in Asia, outside of the merger between Singapore and Sydney, is not truly committed.

Liberty Or Death Mount And Blade

The effect of new banking regulations

This has led Credit Suisse to review its ROE target for the medium term from 18 to 15%, which still seems ambitious, down from 20% before the crisis.

not surprising: studies of JP Morgan or consultant Oliver Wyman concluded that the effect of re-regulation would cost about 1 / 3 of EWN. This one has also not given its full potential for the implementation of Basel will add 3 is very significant reforms ahead of OTC derivatives markets, for once more advanced on the other side of the Atlantic.

This recently led Bill Winter, the former Co-Head of Investment Banking of JP Morgan and member of the British Reform Commission on reform of the banking system in Britain, to predict: The best -run banks Will Be Able to generate a ROE of maybe 13 per cent, 20-25 per one hundred Compared With Historically. There Will Be a middle tier is 9, 10, 11 per cent and below Then The Weakest Ones That. "

The world has changed and banks, especially for investment banks. Three contextual factors have changed: i) the future economic cycle will be less buoyant than the previous ii) financial innovations are likely to be less available after the explosion of derivatives markets during the past 30 years iii) finally, and most importantly, the de-regulation has given way to re-regulation.

This has led Credit Suisse to review its ROE target for the medium term from 18 to 15%, which still seems ambitious, down from 20% before the crisis.

not surprising: studies of JP Morgan or consultant Oliver Wyman concluded that the effect of re-regulation would cost about 1 / 3 of EWN. This one has also not given its full potential for the implementation of Basel will add 3 is very significant reforms ahead of OTC derivatives markets, for once more advanced on the other side of the Atlantic.

This recently led Bill Winter, the former Co-Head of Investment Banking of JP Morgan and member of the British Reform Commission on reform of the banking system in Britain, to predict: The best -run banks Will Be Able to generate a ROE of maybe 13 per cent, 20-25 per one hundred Compared With Historically. There Will Be a middle tier is 9, 10, 11 per cent and below Then The Weakest Ones That. "

Thursday, February 10, 2011

Monday, February 7, 2011

Compound Interest Formula Recurring Deposit

activities instead of going into corporate finance The major players in January

This is apparent from this graph Reuters picked up by FT Alphaville.

This is apparent from this graph Reuters picked up by FT Alphaville.

See link:

http://ftalphaville.ft.com/blog/2011/02/07/481136/ma-high-yield-update/

This is apparent from this graph Reuters picked up by FT Alphaville.

This is apparent from this graph Reuters picked up by FT Alphaville. See link:

http://ftalphaville.ft.com/blog/2011/02/07/481136/ma-high-yield-update/

Subscribe to:

Comments (Atom)