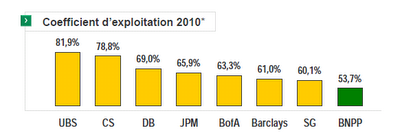

In paper presentations on its results, BNP Paribas provides for 2010, this graphic comparison of operating ratios (cost to income ratio) of investment banking activities, ie the proportion of revenue represented by the costs. These costs are known, are represented in 2 / 3 per pay.

This indicator is intended as a measure of operational efficiency the bank. Nevertheless, it is to be used with caution because the cost to income ratio will depend product mix of each investment bank. Some activities, such as brokerage or corporate finance have a high cost to income ratio because it's all about "people business" but using little capital and can be very profitable. In contrast to market activities and structured finance have operating ratios much lower but are heavy users of capital. This explains, in addition to good management, low operating rate of the two banks françaises.C is also explains that one can have, such as Credit Suisse, a high operating ratio from along with high profitability (see the graphs of a previous post: http://investmentbankerparis.blogspot.com/2011/02/profitabilite-et-profits-des-grandes.html )

This indicator is intended as a measure of operational efficiency the bank. Nevertheless, it is to be used with caution because the cost to income ratio will depend product mix of each investment bank. Some activities, such as brokerage or corporate finance have a high cost to income ratio because it's all about "people business" but using little capital and can be very profitable. In contrast to market activities and structured finance have operating ratios much lower but are heavy users of capital. This explains, in addition to good management, low operating rate of the two banks françaises.C is also explains that one can have, such as Credit Suisse, a high operating ratio from along with high profitability (see the graphs of a previous post: http://investmentbankerparis.blogspot.com/2011/02/profitabilite-et-profits-des-grandes.html )

0 comments:

Post a Comment